China’s youth travellers post-COVID-19

Pre-pandemic, China was the world’s largest outbound tourism market with residents taking 168 million+ trips per year, making this demographic an essential travel market. We caught up with Sienna Parulis-Cook, Associate Director of Communications at Dragon Trail Interactive who brought us up to speed on the youth travel market in China, their habits and the future of Super Apps.

What is different about the post-95 (Generation Z) traveller’s behaviour and spending habits now compared to pre-COVID?

The post-90/post-95 generations are the driving force in the recovery of China’s domestic tourism market that we’ve seen since the late spring of 2020. Rather than reducing travel budgets, these consumers are now often spending more on travel than they did pre-COVID, especially in terms of better quality accommodation and food. Similar to the overall Chinese domestic tourism market right now, there is increased interest in nature and remote, scenic destinations. The younger generation has always been very independent when planning and booking travel, and in the COVID-19 era, interest in traditional group tourism is low.

<pBefore COVID-19, the average age for people born after 1995 and taking their first international trip was 18. Will we see an age increase now there is more uncertainty within international travel?</p

Short term we will see an increase, since there has been no possibility for outbound travel from China for most of 2020 already. Uncertainties around the future of international education – both COVID-related and geopolitical – may also impact youth travel going forward. However, it’s still too early to tell if there will be any long-lasting effects on post-95s’ attitudes and behaviour around international travel, and what these would be.

Travel is regarded among younger travellers to express identity and learn about the world. Are these motivations still relevant to post-95 (Generation Z) travellers?

Although the Chinese tourism market has been entirely domestic during the summer of 2020, travel motivations have not fundamentally changed. Youth travellers still have a keen interest in travelling to explore one’s personal interests, and in experiencing and learning about other cultures. China itself is a vast and diverse country, so domestic travel can still deliver experiences and perspectives that are very different from day-to-day life.

Has there been a shift in how youth travellers are obtaining their travel inspiration? Does video still have market priority on channels such as Douyin?

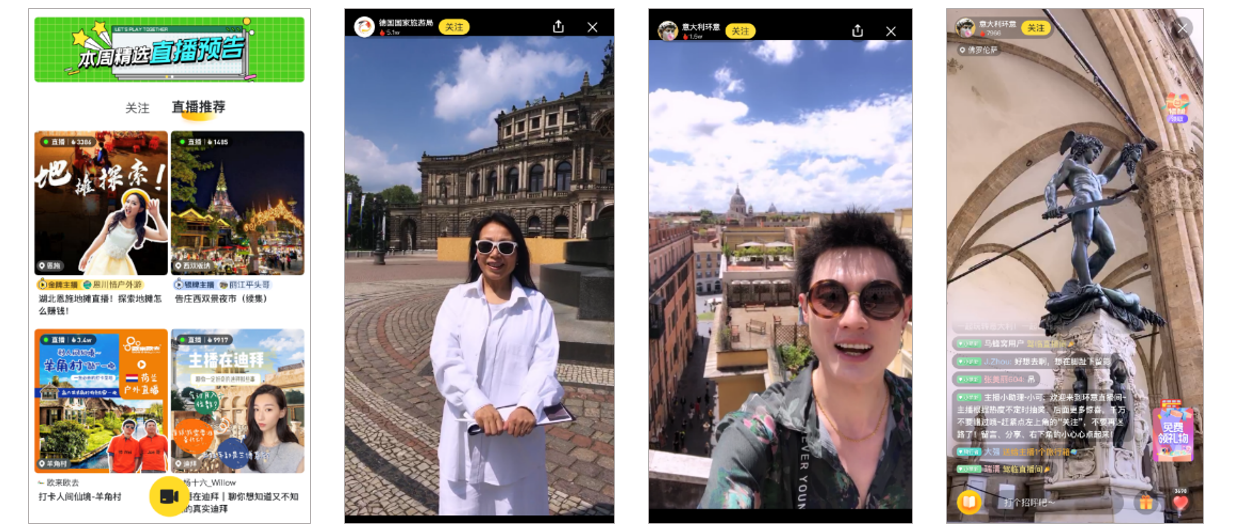

Video is still really key for this market for travel inspiration, and the new extension of that trend is live streaming. Live streaming has been big in China for many years for e-commerce and entertainment, but before COVID-19, it never took off for travel. Since the early spring, Chinese travel and hospitality companies started using live streaming for hugely popular sales events, and live streaming has also caught on for more inspirational tourism marketing. This includes things like a live streaming tour of the Forbidden City in early April, and an ever-increasing number of international tourism boards that have all started live streaming, too: Germany, New Zealand, and Thailand, to name a few early adopters.

President Trump has set out an executive order to stop American firms from working with organisations via WeChat; what are your thoughts on this decision?

Details of the executive order are still emerging. Still, we hope that US businesses operating in China or with the Chinese market will retain their ability to reach and serve consumers on the essential super apps in China.

Overseas tourism brands, including; DMOS, airlines, hotels, and museums, all use WeChat to provide useful information and marketing content, to attract Chinese travellers, help them plan their trips, and improve their experience on arrival. WeChat is also a unique platform for Chinese to communicate with friends and family while abroad, and to share their travel experiences. To lose it would have profound consequences for any business or brand to be able to welcome and communicate with the largest outbound tourism market in the world.

What travel trends within the market in China do you see emerging over the next 12 months?

There are a few key trends that should stand out during the early recovery period:

- The destinations Chinese travel to depends on how well the virus has been brought under control. This could mean that Chinese tourism remains domestic, but it’s likely that some destinations will be designated as “safe” and opened for international tourism without quarantine-on-return. I would expect these destinations to start with selected Asian countries, and then be extended to other areas with proper virus management.

- Driving was already a trend in Chinese tourism, and it looks certain to grow further now. We can already see this both in terms of domestic travel in China and for Chinese who live in Europe and are travelling this summer. Driving is perceived as safer than using public transportation, it fits well with the rise of smaller travel parties, and allows for more freedom in getting off the beaten track to remote destinations, which are all critical to consumers right now.

- Shift to independent travel and customised tours for smaller groups at smaller destinations. This fits with the style of travel that young Chinese prefer, and gives travellers more peace of mind during the COVID-19 era than travelling on a bus with a large group of unknown people.

Could you share one piece of advice you would give to travel providers who want to engage with the youth market in China?

It’s imperative to keep engaging with and welcoming Chinese travellers through digital channels. By continuing to create content aimed at China’s travellers through Chinese platforms, you can plant long-term seeds of inspiration and also make sure that you’re promoting your destination or business as welcoming to Chinese visitors – in the COVID-19 era, this is more important than ever. On WeChat, reading rates have stayed remarkably stable in 2020 compared to 2019, showing that Chinese consumers are still engaging with content. Travel brands that have stayed active have been rewarded with high readership rates and engagement and increased followers, not to mention the long-term impact on how people view the destination and make long-term travel plans.

Sienna will speak at WYSTC 2020 Online in her session, Winning China’s young travellers. Want to hear more? Secure your place at WYSTC.

Recent Comments